Brands like to keep their finger on the pulse when it comes to their health. Smart, but then you have to measure the right things. In this blog, you'll read about which brand health metrics provide a meaningful reflection of the health and growth potential of brands.

The purpose of brand tracking is, on the one hand, to see the impact of marketing efforts reflected in visible KPIs. On the other hand, tracking is useful for spotting early indicators that signal an increase or decrease in market share.

But which metrics are worth measuring? In theory, you could measure hundreds of metrics, leading some brand trackers to expand into questionnaires that seem endless. Needless to say, this makes it challenging for brand managers to act on.

How Byron Sharp Changed Brand Tracking

In this blog, we highlight the key brand health indicators. We refer a lot to the work of Byron Sharp, who, with his "How Brands Grow" books, has strongly influenced the growth strategies that brands pursue today. But to grow according to Byron Sharp's laws, you also need to measure according to Byron Sharp's laws.

The core of Sharp's message is pessimistic and practical at the same time: brands are not particularly important in the lives of consumers. Brand growth occurs where brands become more accessible (physical availability) and where they build a more extensive association network in our brains (mental availability). Brand tracking focuses on making that second factor measurable: the memory structures with which the brand is intertwined.

Classic brand trackers tend to focus on the wrong metrics (such as brand love), or they fish in the right direction but measure them in the wrong way (such as consciously asking about image instead of measuring implicitly).

Below, we outline how to measure mental availability best to make the growth indicators of your brand measurable.

1. The Basics of Brand Health Tracking

A pitfall of Brand Health Tracking is that you could potentially ask about everything. In the book "Better Brand Health" by Jenni Romaniuk, associated with the Ehrenberg-Bass Institute, she shares empirical research on the sense and nonsense of various brand health tracking metrics.

Brand Awareness is one of the most commonly used basic metrics in brand health tracking. Brand awareness has many forms, such as spontaneous awareness ("which beer brands do you know?"), top-of-mind awareness ("what is the first beer brand that comes to mind"), and aided awareness ("tick the beer brands you know"). Interestingly, aided awareness, especially among non-buyers of the brand, is a valuable (but still rough) indicator of brand health. Spontaneous measures are often less reliable and overvalue the most well-known brands while undervaluing less known brands.

The basic module of our tracker eliminates the proliferation of metrics of dubious value. The module covers awareness, attitude, and word-of-mouth.

- Brand Awareness: Focus especially on aided brand awareness (with a list of brands that can be checked). Awareness among non-buyers of the brand is a valuable health indicator.

- Brand Attitude

- Word-of-mouth

2. Brand Image

Brands and categories are nothing more than association clusters in our brains. Many questions in the field of brand health tracking revolve around the image. What is the impact of a campaign? How does the brand compare to competitors on specific attributes? To answer such questions, it is essential to make these association clusters measurable.

However, you cannot simply ask people about the often subtle effects of brand associations. Since this is a mostly automatic and rapid process in our brains, we are hardly aware of it. Classic questioning would therefore yield incorrect answers.

Reaction time reveals association strength

The Intuitive Response Test (IRT) breaks through this conscious barrier by showing the respondent quickly various combinations of brands and attributes. The respondent indicates for each attribute with a key whether it fits the brand or not. The stronger an association, the faster one can react.

The brand image measurement in a brand tracker uses this reaction time task to gain insight into the actual brand associations in the mind of the category buyer.

![]()

What associations are worth measuring?

Although you can measure any conceivable association with the IRT, it is wise to focus on associations that truly play a role in the consumer's purchase decision. The stronger your brand addresses innate human core motivations, the more relevance the brand enjoys in the mind. This results in an increase in brand awareness, brand preference, and ultimately, market share growth. The core motivations include:

- Pleasure

- Comfort

- Connection

- Status

- Well-being

- Lust

- Control

- Growth

More on brand image research can be found here.

![]()

3. Marketing Reach

To what extent has the category buyer been effectively exposed to your advertising campaigns and other marketing efforts? If you have been actively engaged in outward marketing for a period, it is essential to make its reach visible.

Campaigns have two specific challenges to overcome. Firstly, they need to stand out and leave a trace in memory. However, if everyone remembers your message, the campaign is not necessarily successful. Secondly, the brand needs to be activated so that the memory traces left by the campaign actually benefit the brand. With your brand health tracker, you periodically measure the extent to which the brand's campaigns have succeeded in this aspect.

How to Measure the (Meaningful) Reach of Your Message

Respondents are presented with a collage of a campaign, stripped of all brand-identifying elements, such as the logo. Initially, respondents are asked to indicate whether they have seen this campaign. If they recognize the campaign, they are then asked to identify the brand.

To keep the test unbiased, four campaigns from competitors in the category are also shown for each target campaign.

Reach: % of category buyers who recognize the message

Correct Branding: % of people who, after recognition, correctly identify the brand

Branded Reach: % Reach * % Correct Branding

4. Category Entry Points (CEPs)

Byron Sharp highlighted the importance of Category Entry Points (CEPs) in his book "How Brands Grow." Brands associated with various usage situations in the consumer's mind are chosen more frequently in purchase situations, being top of mind in more situations and attracting attention faster. Measuring your mental availability—the extent of your CEP network—is a crucial component of the brand tracker.

Mental Availability Metrics

Respondents are presented with a specific CEP (such as a usage moment) along with a list of brands. Respondents mark which brands are associated with the CEP. Both the order in which CEPs are presented and the list of brands are randomized.

- Mental Market Share: The % of CEP associations that your brand has as a fraction of the total number of CEPs within the category.

- Mental Penetration: % of category buyers who associate your brand with at least one CEP.

- Network Size: Average number of CEPs linked to your brand (measured among people familiar with the brand). An increase in network size signals that marketing has had a positive impact on the brand, indicating imminent brand growth.

5. Distinctive Brand Assets (DBAs)

A brand asset is anything that can activate the brand in the consumer's memory. Common brand assets include logos and symbols (Nike's swoosh), slogans (McDonald's "I'm lovin' it"), packaging (Coca Cola's bottle), color (Milka’s purple), music, sounds, and jingles (Hornbach’s Kama-jaja-jippie-jippie-jee), advertising executions (Centraal Beheer’s ‘Even Apeldoorn bellen’), characters (Albert Heijn’s Harry Piekema), and celebrities (Gillette’s athlete endorsements).

Brand assets act as mental glue, making it easier for your brand to stand out and expand its association network. The development of brand assets is characterized by a snowball effect: the more assets you have, the easier it is to add more assets and category entry points to this memory network. Big brands have it easy.

How to Measure Brand Assets

Follow the validated test protocol to measure brand asset strength (Romaniuk & Nencyz-Thiel, 2014). The respondent is shown various stand-alone brand assets (such as images and sounds) in random order. Only the associated category is prompted alongside the asset, and the respondent must indicate which brands come to mind. Based on these responses, we can map the Fame and Uniqueness scores of each brand asset.

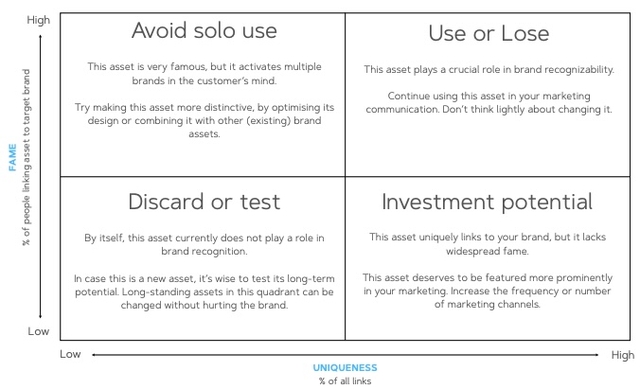

Fame and Uniqueness Guide Your Course

The results of the brand asset test provide practical guidance for optimizing the brand's course. This is built on two performance metrics:

- Fame: % of category buyers associating the asset with the brand.

- Uniqueness: % of links with the target brand compared to the total number of mentioned brands.

The Fame and Uniqueness scores of an asset indicate which effectiveness quadrant each asset falls into. Each quadrant points to a specific course of action to help strengthen the asset as quickly as possible:

- Use or Lose: The most powerful assets, where caution is needed with significant changes.

- Build on Uniqueness: This asset is unique but not yet famous. More use/channels can benefit the asset.

- Avoid Solo Use: This asset is famous but reminiscent of multiple brands. Further refinement can help make the asset more unique.

- Ignore or Test: The asset has (yet) no value. Can be easily replaced or adjusted.

6. Buying Behavior

Finally, it is valuable to measure how buying behavior is distributed within the category and what role your brand plays in it.

The buying behavior module serves two objectives. Firstly, the data provides insight into shifts in market dynamics: how often people buy in the category and how brand loyal they are. This insight reveals important market trends.

Secondly, querying brand usage yields a variable that can be included in the analysis of the other five modules by splitting into buyers and non-buyers of the brand. For example, growing mental market share among non-buyers is a strong indication of future brand growth.

Behavioral Variables

- Frequency: How often does the customer buy in the category?

- Repertoire Format: How monogamous and polygamous are category buyers towards their brands?

- Usage: Distribution of light and heavy users.

- Brand Penetration: % of category buyers who bought the brand during a period.

Start with Brand Health Tracking

Unravel Research's brand health tracker follows proven principles behind brand growth, including the empirical laws of brand growth as popularized by Byron Sharp. But we also look at neuroscience research: our brand tracker is enhanced with the latest neuromarketing methods to measure unconscious associations.

![]()

Utilize the 6 Modules

Unravel's brand health tracker includes the 6 modules covered in this blog. The modules differ in how often they should be measured per year, as some metrics naturally develop more slowly than others.

Below, we list the optimal measurement frequency for each module:

- Base Module: Monthly to quarterly

- Image: Quarterly

- Marketing Brand Reach: Quarterly (if there are outward marketing campaigns)

- Category Entry Points: Annually

- Brand Assets: Annually

- Buying Behavior: Annually

Many brands choose to measure a 'light variant' more frequently and perform the complete tracker on an annual basis.