Neuromarketing Pricing Research

-

Research into the optimal price level of your product

-

More accurate than traditional research methods

-

Conducted using the best method for pricing research: EEG (ERP Analysis)

Applications

Stop gambling. Neuro measures the optimal price for your product.

For as long as marketing has existed, marketers have been trying to unravel the perfect price for their product. Yet price turns out to be one of the most difficult product factors to study properly.

Traditional surveys provide little guidance. Questions about price acceptance, willingness to pay or purchase intentions push the consumer into a rational mindset. This specific mindset is extremely rare in actual price interactions. Above all, prices are processed intuitively. Classical metrics therefore fail to put their finger on the real impact of prices.

Neuromarketing pricing research is currently revolutionizing price research. It offers an unprecedentedly accurate measurement of which price intuitively fits a product best. Unravel Research applies this method to answer questions on price changes and product introductions.

Increasing prices? This is how much you can increase without losing sales volume:

Introducing a price increase can be tense. Will it affect demand for the product?

Neuro price research provides a concrete picture of price acceptance at any price level. This allows you to predict in advance whether demand will decrease, stay the same or increase with the introduction of a new price. This provides a solid rationale for pricing your product.

Introducing a new product in the market? This is the perfect introductory price:

Or discuss the possibilities with Tim, our Lead Consultant

View availability and schedule an online appointment

How does it work?

By measuring this neural response at varying price levels, you gain insights into the extent to which each price point suits the product emotionally. In neuro-price research we measure this N400 response at a large number of price points, so that we can produce a complete price acceptance curve.

The results: surprisingly simple

Unlike traditional price acceptance methods, neuro price research provides a simpler - and therefore also more practical - end result. Per price level, you gain insights into the degree of price acceptance as measured in the customer's brain. Nothing more and nothing less.

This price acceptance curve is strongly linked to actual behavior. So you will know exactly in what direction and magnitude demand increases or decreases at a different price level.

Difference with traditional price research

In many neuro pricing studies, we combine EEG research with a more traditional method such as Van Westendorp, conjoint analysis and/or willingness to pay.

Interestingly, we see a clear trend in the difference between neuro pricing research on the one hand and traditional methods on the other.

One obvious law that we see again and again is that both research forms predict roughly in the same direction, but the optimal price level from neuro tends to be somewhat higher compared to traditional advice. In other words, classical research makes many products too cheap.

This is not surprising. Consciously asking about price acceptance makes the respondent more price-conscious by definition - and thus more critical - than an intuitive measurement in the brain. Thus, EEG provides a more accurate picture of actual price acceptance in store.

Or discuss the possibilities with Tim, our Lead Consultant

View availability and schedule an online appointment

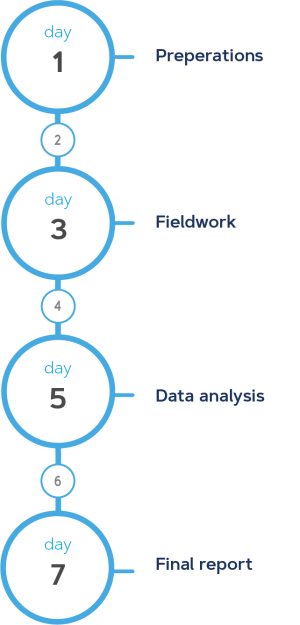

Timeline of neuro price research

-

Day 1-2: Kick-off & preparation

In the first week, the products, the to-be-measured price range and desired price intervals are determined in consultation with the customer. Thereafter a test panel is recruited and the research battery will be prepared. -

Day 3-5: Field work

During the fieldwork, 30 respondents will visit the Unravel Living Room Lab. Here they will be equipped with the EEG, whereafter they will be presented with the products with different price levels in a randomized order. The measurement and research environment are comfortable and homey, so that we can guarantee the most natural measurement possible. -

Day 6-7: Data analysis and report

To arrive at solid acceptance data per price level, the data is extensively decontaminated and then analyzed in combination with machine learning algorithms to put the data into acceptance metrics. The result of this complex analysis is surprisingly simple: a clear price-acceptance graph in which you can see the brain acceptance per price level.

Or discuss the possibilities with Tim, our Lead Consultant

View availability and schedule an online appointment

Facts

> 425

7

9

Frequently Asked Questions

It is indeed possible to include the context of the product in neuro pricing research. For example, what is the optimal price point for a candy bar in the supermarket and what is the optimal price point for that candy bar in a gas station? Here, the respondent sees the product and price point in varying settings.

We mean business with

EN

EN  NL

NL