Category Entry Point (CEPs)

Onderzoek

-

Boost je merkgroei door meer koopsituaties te bezitten

-

Meet mentale beschikbaarheid: Ontdek op welke CEP's je merkt wint, en waar het wordt vergeten

-

Direct toepasbare inzichten, klaar binnen 7 dagen

Toepassingen

De marketingwetenschap laten er geen misverstnad over bestaan: succesvolle merken zijn simpelweg die merken die spontaan opkomen in uiteenlopende koopsituaties. Die situaties, ook wel Category Entry Points (CEPs) genoemd, zijn de mentale triggers die aankoopgedrag in gang zetten. Denk aan: “Ik ben gestrest”, “Voor bij de wedstrijd” of “Om aan mijn kinderen te geven.”

Wat topmerken onderscheidt van de rest? Ze hebben een rijk netwerk van deze mentale haakjes opgebouwd in het brein van de consument. Hoe meer haakjes je merk heeft, hoe groter de kans dat het herinnerd – en gekocht – wordt op het moment dat het ertoe doet.

CEPs zijn de gedachten, emoties en contexten die jouw merk op precies het juiste moment in het bewustzijn van je potentiële koper doen oplichten. Zoals:

- Gatorade na een stevige workout

- Ben & Jerry’s bij een late-night craving

- Tylenol bij een bonkende hoofdpijn

Unravel Research helpt je deze mentale haakjes te identificeren, meten en versterken. Zo maak je jouw merk top of mind is op de momenten waarop keuzes worden gemaakt.

Deze aanpak is gebaseerd op het werk van marketingscientist Byron Sharp en het Ehrenberg-Bass Institute, zoals beschreven in het standaardwerk How Brands Grow.

Het draait niet om wát mensen van je merk denken – maar wannéér

Hoe graag je het ook zou willen, consumenten denken echt niet de hele dag aan je merk. Dat hoeft ook niet. Waar het om gaat is dat activatie op het juiste moment – een craving, een probleem, een sociale situatie – de merken die als eerste te binnen schieten een flinke voorsprong hebben.

Mental availability (mentale beschikbaarheid) gaat over top-of-mind zijn in die situaties waarin keuzes worden gemaakt.

Category Entry Points geven je inzicht in die beslissende momenten en laten zien hoe sterk jouw merk daarop laadt.

Krijg advies bij het benutten van CEP's

CEPs meten is pas het begin. De merkgroei hangt af van wat je met die informatie doet.

Bij Unravel Research stoppen we daarom niet bij cijfers. We helpen je om inzichten om te zetten in concrete merkstrategie. Zodra we in kaart hebben welke entry points jouw merk al bezit, en welke nog niet eraan gekoppeld zijn, gaan onze consultants met je aan de slag om:

- CEP’s met het grootste groeipotentieel te prioriteren

- Zwakke associaties te veroveren met gerichte communicatie

- Creatie, media en verpakking af te stemmen op cruciale koopsituaties

- Braakliggend breinterrein identificeren

Met onze expertise in consumentenpsychologie en neuromarketing helpen onze groeiconsultants merken om langdurig mental availability op te bouwen.

Of bespreek de mogelijkheden met Tim, onze Lead Consultant

Bekijk beschikbaarheid, en plan een online afspraak in

Hoe het Werkt

Ons CEP-onderzoek combineert marketingwetenschap met gedragsinzichten. Zo brengen we in kaart hoe en wanneer jouw merk opduikt in het hoofd van de consument.

Stap 1: CEP Pilot - Ontdek de juiste entry points

Elke categorie kent een volstrekt uniek CEP-landschap. Dit zijn de momenten, behoeften, emoties en contexten die aankoopgedrag van jouw potentiële koper in gang zetten.

In een eenmalige pilotstudie ontrafelen we allereerst de meest relevante CEP’s binnen jouw categorie. Daarbij gebruiken we het bewezen 5W-framework:

- When: Wanneer ontstaat de behoefte?

- Where: Waar bevindt de consument zich?

- Why: Waarom is de categorie op dat moment relevant?

- With whom – Met wie wordt het moment gedeeld?

- With what (feeling) – Met welke ander object, activiteit en/of gevoel wordt het moment geassocieerd?

Deze eerste stap brengt de CEP’s in kaart die het meest bijdragen aan merkherinnering en legt het fundament voor langdurig opwaartse groei in mental availability.

Stap 2: Doorlopende CEP-monitoring

Zodra jouw CEP-landschap in kaart gebracht is, monitoren we structureel hoe sterk jouw merk – en je concurrenten – aan elk entry point is gekoppeld. De meeste klanten kiezen voor jaarlijkse tracking om voortgang te meten en de strategie te optimaliseren.

We meten prestaties op drie wetenschappelijk gevalideerde metrics:

- Mental Market Share: Hoe vaak wordt jouw merk herinnerd over alle CEP’s heen?

- Network Size: Aan hoeveel verschillende CEP’s is je merk mentaal gekoppeld?

- Mental Penetration: Hoeveel consumenten linken jouw merk aan ten minste één relevant CEP?

Deze metrics zijn sterke voorspellers van toekomstige merkgroei. Hoe groter je mentale footprint in koopsituaties, hoe groter je groeipotentieel.

Snel, schaalbaar en strategisch

Het onderzoek wordt uitgevoerd via een gestructureerde, online survey; snel, schaalbaar en kostenefficiënt. Inzetbaar voor zowel eenmalige inzichten als continue merkmonitoring.

Unravel levert niet alleen data, maar concrete strategische aanbevelingen:

✔ Welke CEP’s je moet verdedigen

✔ Welke CEP’s je kunt laten groeien

✔ Welke witte ruimtes je nú moet claimen voor je concurrenten dat doen

Of bespreek de mogelijkheden met Tim, onze Lead Consultant

Bekijk beschikbaarheid, en plan een online afspraak in

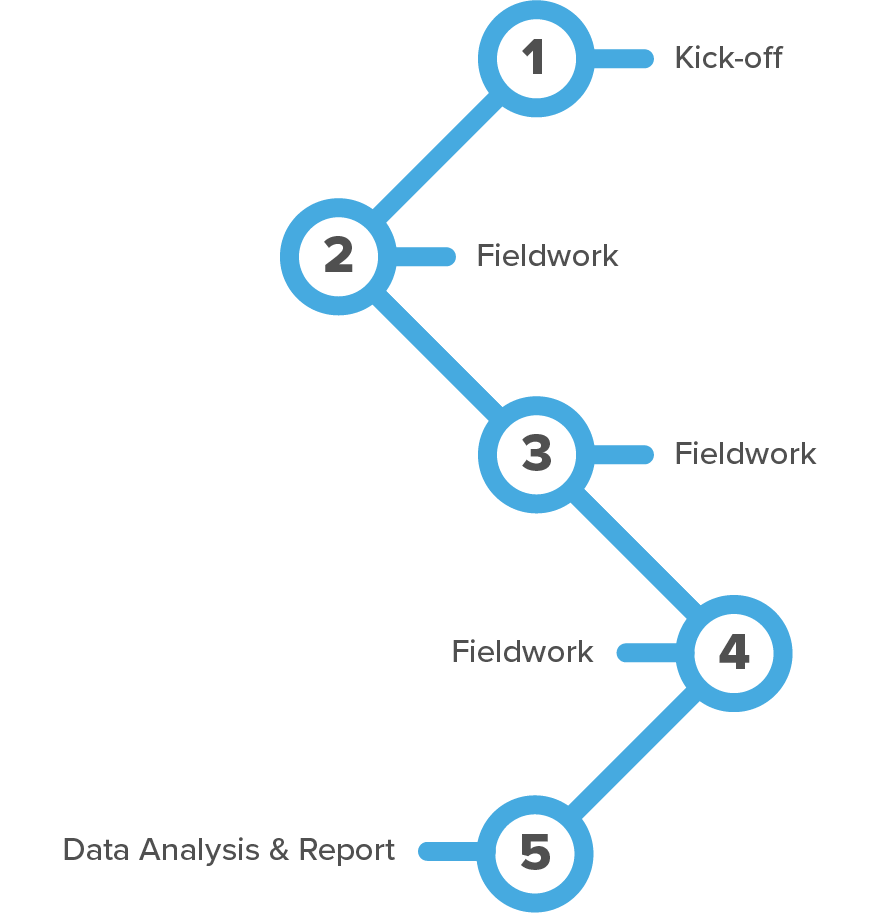

Project Timeline

Dankzij onze slimme automatisering van dataverzameling en analyse kan Unravel Research een ongeëvenaarde doorlooptijd van 5 dagen bieden voor CEP-onderzoek.

-

Dag 1: Kick-off

Tijdens een kick-offsessie inventariseren we alle CEP's die onderzocht moeten worden. Voorafgaande aan de eerste meting is het gebruikelijk eerst een verkennende pilot te verrichten naar relevantie CEP's.

-

Dag 2-4: Veldwerk

Werving van respondenten en dataverzameling. Wij adviseren 150 respondenten per cel voor betrouwbare inzichten.

-

Dag 5: Data Analyse & Rapportage

We analyseren de prestaties van elk asset op bekendheid (fame) en onderscheidend vermogen (uniqueness). De resultaten worden overzichtelijk gepresenteerd in een rapport met heldere, actiegerichte aanbevelingen.

Of bespreek de mogelijkheden met Tim, onze Lead Consultant

Bekijk beschikbaarheid, en plan een online afspraak in

Extra Onderzoeksmodules

Onze merkonderzoeken test draait rechtstreeks in Qualtrics en kan eenvoudig worden geïntegreerd met andere onderzoekmodules, zowel die van Unravel als die van jouw eigen organisatie.

Category Entry Point-metingen worden vaak gecombineerd met de volgende modules:

Brand Awareness. Meting van spontane en geholpen merkbekendheid

Brand Image. Inzicht in perceptie en merkassociaties

Brand Asset Testing. Evaluatie van de kracht van visuele en verbale merkelementen

“The Neuro Research proved to be very valuable to us. We made a deliberate choice for neuromarketing research. We don't want socially accepted answers, we want real insights.”

Voorbeeldoutput

Hieronder vind je een voorbeeld van de output van CEP Measurement: een overzicht van geaggregeerde Mental Availability metrics en performance per CEP.

Curious what a complete report looks like? As the reports for our clients are confidential we made an example report.

You can download it below:

Of bespreek de mogelijkheden met Tim, onze Lead Consultant

Bekijk beschikbaarheid, en plan een online afspraak in

Facts

> 750

CEP's tested

5

9

Frequently Asked Questions

Een Category Entry Point is een echte, herkenbare koopsituatie. Het is het moment, de context, locatie of behoefte die ervoor zorgt dat iemand aan een productcategorie denkt.

Voorbeelden:

- “De avond van de wedstrijd” → bier

- “Ik ben gestrest” → chocolade

- “Een lange rit voor de boeg” → energiedrank

Met CEP-onderzoek breng je in kaart welke van deze koopsituaties jouw merk claimt en welke juist door je concurrenten worden gedomineerd.

Hoe meer mentale haakjes jouw merk heeft, hoe vaker het spontaan opkomt - en wordt gekozen! – op het moment van aankoop.

Om je merk te laten groeien draait het niet alleen om wat mensen van je merk vinden, maar vooral wanneer ze eraan denken.

De meeste consumenten lopen niet de hele dag rond met jouw merk top-of-mind. Aankoopbeslissingen worden vaak in een paar seconden genomen, op basis van het eerste merk dat spontaan opkomt bij een bepaalde behoefte.

Onze CEP-meting richt zich precies op dat moment van herinnering. Dit is een veel sterkere voorspeller van verkoopsucces dan traditionele merkperceptie- of imagometingen.

We meten drie wetenschappelijk gevalideerde metrics:

- Mental Market Share- Hoe vaak komt je merk naar boven bij relevante CEP’s?

- Network Size- Aan hoeveel verschillende CEP’s is je merk mentaal gekoppeld?

- Mental Penetration- Hoeveel consumenten associëren jouw merk met ten minste één CEP?

De relatie tussen deze metrics en daadwerkelijke merkgroei is uitvoerig onderbouwd in het werk van Byron Sharp (How Brands Grow) en Jenni Romaniuk (Better Brand Health).

Het is simpel: hoe meer CEP’s jouw merk claimt, hoe meer koopmomenten je activeert.

We meten drie kernmetrics:

- Mental Market Share

- Network Size

- Mental Penetration

Deze metrics hebben een bewezen verband met toekomstige omzetgroei. Vergroot je deze scores, dan vergroot je je marktaandeel.

Bovendien weet je na het onderzoek exact welke CEP’s jouw merk bezit, én waar nog kansen liggen. Zo krijg je heldere strategische richting voor duurzame merkgroei.

De meeste merken starten met een eenmalige pilot om via ons 5W-framework de belangrijkste koopsituaties in hun categorie te ontdekken

Daarna adviseren we jaarlijkse tracking. Zo kun je de voortgang meten, concurrenten voorblijven en de mental availability van je merk scherp houden.

Absoluut. Elk onderzoek wordt volledig afgestemd op jouw categorie, doelgroep en marktambities.

We passen onder andere aan welke CEP’s we meten, welke concurrenten we meenemen in de benchmarking, en segmentatie op regio, klanttype of high-value doelgroepen als dat wenselijk is.

Zo krijg je inzichten die direct toepasbaar zijn op jouw merkstrategie.

Je ontvangt een helder, executive-ready rapport met:

- Een overzichtelijke CEP-map die laat zien waar jouw merk voorloopt, achterblijft of nog 'braakliggende' CEP's kan claimen

- Competitieve benchmarks die exact tonen waar je staat ten opzichte van concurrenten

- High-prio actiepunten om je mental availability gericht te laten groeien

Kortom: strategische inzichten die direct vertaald kunnen worden naar merkimpact.

Voor een CEP-pilot adviseren we 50 tot 100 respondenten, met het criterium kopers binnen de categorie. Meestal betekent dit: consumenten die in de afgelopen 6–12 maanden iets uit de categorie hebben gekocht (afhankelijk van de markt). Zo zorgen we dat de resultaten gebaseerd zijn op mensen die daadwerkelijk tot category buyer worden gerekend.

Voor doorlopende tracking is een steekproef van 200 categoriegebruikers per cel gebruikelijk. Elke respondent beoordeelt alle relevante merken, wat de vergelijkbaarheid binnen de concurrentieset maximaliseert.

Wil je data uitsplitsen naar segmenten of koopgedrag? Dan zal de steekproefomvang toenemen.

Zeker. Veel van onze klanten combineren CEP-meting met bestaande merkonderzoeken, zoals brand health tracking, ad tracking of brand asset studies.

Unravel’s Brain-Based Brand Tracker brengt al deze onderdelen samen in één geïntegreerd merkdashboard.

Liever standalone? Geen probleem. We kunnen het onderzoek ook los uitvoeren, of naadloos integreren in jullie huidige brand tracker, bijvoorbeeld via survey-integratie en het koppelen van respondent-ID’s.

Onze klanten

We mean business with

NL

NL  EN

EN